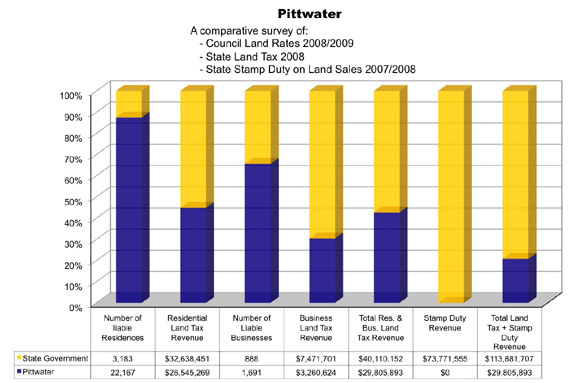

Pittwater freehold housing (like many other local government areas) has been targeted with State Land Tax rate 1000% higher than the Pittwater council residential rate.

State land tax is designed to undermine freehold rental housing and holiday accommodation but media reports on the damage state land tax inflicts never raise the ‘How’ and ‘Why?’ questions.

State land tax is designed to literally force a liable property to be sold; this then generates stamp duty GST etc. This is the agenda of state land tax in Pittwater and most other LGAs.

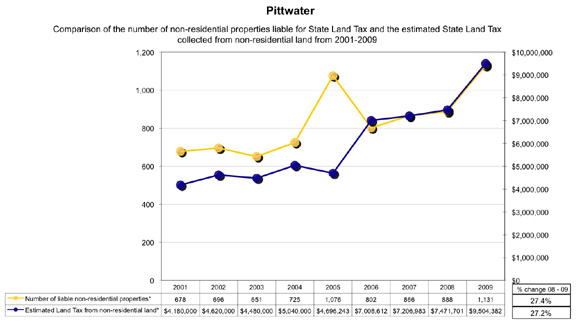

The State land tax tracker shows a dramatic escalation in Pittwater.

Since 2001, State land tax on Pittwater rental housing has grown dramatically especially from 2005 onwards.

In 2001 from 2635 liable residential properties:

State land tax = $14,400,000.

In 2009 from 3513 liable residential properties:

State land tax = $37,664,000

From 2001 ($14,400,000 in tax) State land tax increased to $22,152,000 in 2005. By 2009 State land tax from 3513 residential properties raised $37,664,000.

Pittwater is a classic example of state land tax agenda to impact freehold housing. ‘How’ and ‘Why’?

How this agenda is designed is not generally understood.

The following articles from The Weekend Australian Financial Review puts things in perspective.

– Mike

April 9–10, 2011

The Weekend Australian Financial Review

Palm Beach: a tax hit haven

Report Ruth Liew and Ben Hurley

Palm Beach on Sydney’s north shore may be the playground of the rich but soaring land tax bills are forcing even wealthy holiday home owners to pack up and sell.

A six-bedroom, four-bathroom mansion at 112 Iluka Road, just seconds from the beach, recently sold for $5.75 million.

The land value assessment, which doesn’t include the house, came in at $5.8 million and the previous owner had paid about $100,000 in land tax last year.

Rapidly climbing land valuations are a key factor behind the current oversupply of listings at Palm Beach, according to Andrew Tunbridge, associate director of Ponton Valuations.

Twice as many homes are now on the market as this time last year.

“There’s been a storm brewing in that area”, Mr Tunbridge said. “Many executives’ remunerations have dropped significantly, and many sellers have sold to reduce debt and liabilities, and one of the key liabilities is land tax.

“[Palm Beach] is the most impacted because there’s such a high concentration of holiday homes in that area … and therefore subjected to land tax.”

The land value of 112 Iluka Road jumped from $4.08 million to $6.12 million between 2008 and 2009, pushing up the land tax.

(The statutory value dropped marginally in 2010.) In NSW, land tax is not paid on a person’s principal residence, but does apply to secondary properties.

Real estate agents are baffled by the rise in statutory land values because a surge of forced sales pushed prices down by up to 50 per cent during the financial crisis.

Claudio Marcolongo, principal of LJ Hooker Avalon, said the Illuka Road sale was not an isolated incident.

“The view of. the Valuer General seems to be the value of the land has gone up but the value of the improvements has gone down,” Mr Marcolongo said. “So that’s how they keep increasing them “ taxes.”

Ray White Palm Beach selling agent Michael King said banks were being tough with finance but land tax remained the biggest issue for buyers.

Land values a key factor… the former owner of this home (above) had to pay $100,000 a year in land tax. (Below) 5a Beach Road will be auctioned by the receiver with hopes of fetching less than it cost to build.

“It’s a question every buyer asks, ‘What’s the land tax? How much holiday rental can I get to offset that?’ That’s the first question,” he says.

“The imposition has been there for some time, but people are becoming increasingly aware of it with property prices flat-lining. People will cop it if there’s capital growth.”

Sales volumes in the area have slowed to a trickle this year and buyers willing to foot the tax bill, or make the area their primary home, have an array of stunning properties to choose from.

Many are millions of dollars cheaper than earlier prices.

Dr Andrew Wilson, economist at Australian Property Monitors, believes buyer momentum will start to be “really evident” by August this year, just in time for the spring buying season.

However, how much the market will improve will depend heavily on overall stockmarket performance.

“Taxes lag between what’s happening in the market and the land … that’s why we’re getting that [tax] disparity,” Dr Wilson said.

“Eventually the market recovers… but in the interim you’re forced to pay land tax that its market value doesn’t reflect.”

Surf’s up and down

Homeowners along Victoria’s Surf Coast are turning to the courts to overturn council land valuations. The popularity of holiday homes in towns like Lome, Torquay, Jan Juc and Fairhaven has forced up land prices, causing property values to rise by about 19 per cent in Aireys Inlet. Owners fearing the link between the rising value of their property and an increasing rates bill are taking the council to task.

In a case before the Victorian Civil and Administrative Tribunal this year, Fairhaven landowners Christopher and Margaret Johnson successfully bartered down their council land valuation from $2.5 million to $1.47 million.

The Surf Coast Shire Council argued the Johnsons’ oceanfront allotment was worth more because it was possible to build another home on the site.

The director of Harcourts Mandurah, Clare Seamer, says West Australians face the same issues. “Our council rates have gone up a few hundred dollars in the past few years, while property prices have fallen 20 to 30 per cent since 2007,” she says.

In Brisbane, Place Estate Agents’ Damian Hackett says state “unimproved land” valuations overtook property values before the GFC but had fallen since.

Scott Elliott