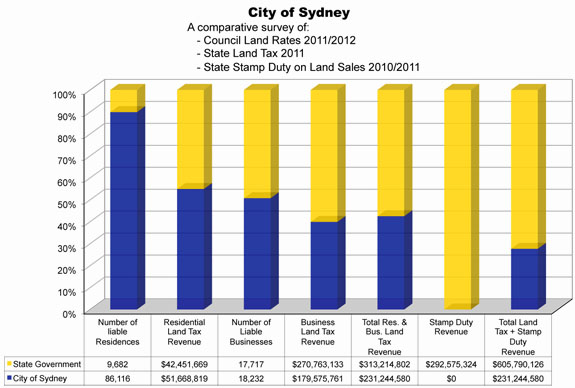

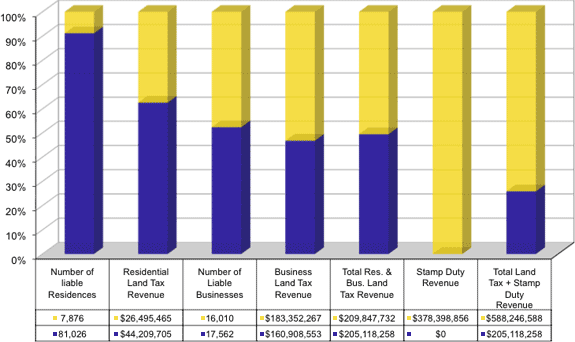

The Comparative Graphs

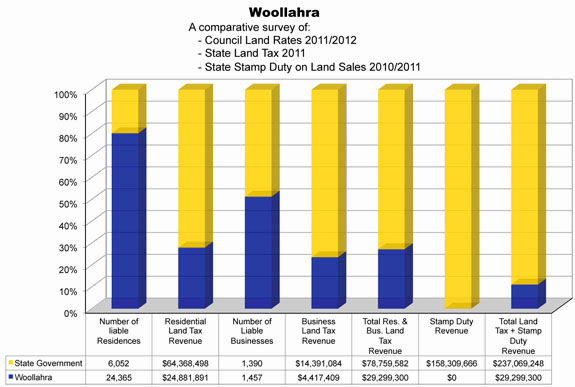

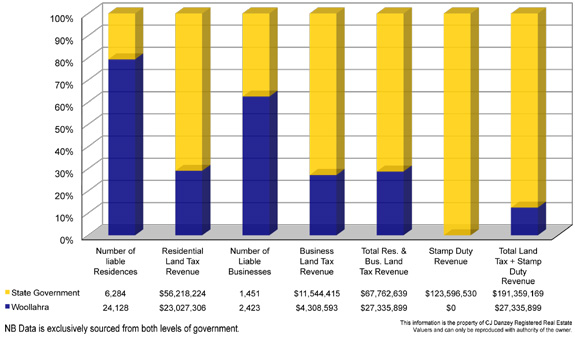

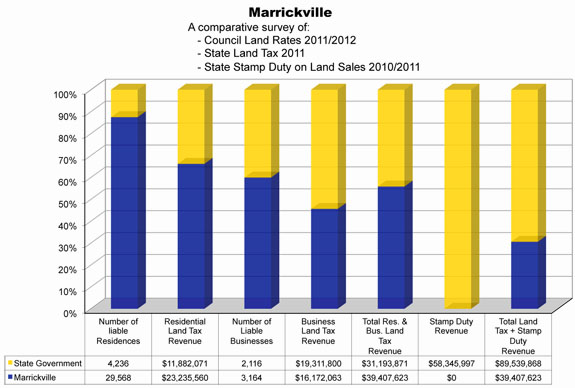

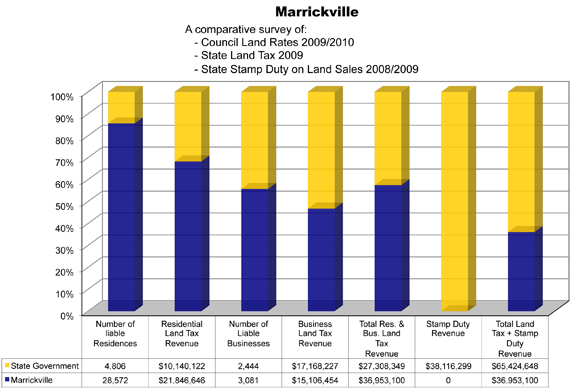

The poll graphs provide a comparison between State Land Tax (SLT) and local council land tax—which most people call “council Rates”.

[we will be posting more comparative graphs soon]

All land values for land taxing in NSW, are set by the Valuer General, (the VG engages private contractors) using a valuation process known as the “statutory mass valuations methodology” that deems all land as vacant land ready to build, for land taxing and set on a common date within each council area.

This valuation process is the instrument the VG must apply when setting each council’s “Valuation Rolls”, which, councils must use to impose council land tax “Rates”.

The council rolls are re-set every three years. State Government also imposes SLT on land value set by the VG, applying the same valuation methodology. For SLT, land values are adjusted annually.

Transparency removed

The intergrity of the mass valuation process was/is seriously damaged when the Carr Government removed public/residents access to council valuation rolls. Removing “transparency” defiled the process, taking away an integral element of the mass valuation methodology intent, to be “transparently open, fair, seeking to equitably distribute the funding of council’s among Rate-payers”.

Removing transparency abolished a long-established element to safe-guard the veracity of the process, by giving resident the right to scrutinise and inspect council valuation rolls, a right that was sacrosanct, until the Carr Government came along.

Only recently The Sydney Morning Herald reported – May 2012 – 9th April /12 by Sean Nicholls, and headed BLOWTORCH APPLIED TO LAND TAX VALUATION raised serious concerns about valuation inconsistencies for land taxing. exposing why the valuation process was/should be transparent.

Taxing Land as vacant, taxes redevelopment value of Land.

By deeming of all land as vacant to set land values for land taxing, effectively, is taxes all private land on re-development value, or future use within each council area. This methodology is called. “Highest and best use valuation”, an economic term, NOT, intended to be a planning term. However, state Treasury has designed SLT agenda to exploit the this valuation methodology,aware it impacts freehold land existing use,accordingly, SLT is used as a ruthless stealth planning weapon,without mandate. In established council areas vacant land is a rare sale, still, “all land is land taxed as vacant ready to build” a planning situation that may not eventuate in 50 years, yet, is taxed today at a rapacious SLT tax rate.

State Treasury aware it exploits the mass Valuation methodology

The NSW Treasury is aware the mass valuation methodology was intended to set Local Government valuation rolls, applying a methodology to impose its land tax “Rates” and seeking the equitable spread of councils’ funding among ratepayers.

Done, basically by councils

- Council are bound to apply the same land tax “Rate” to all land in same class,

- Tax land values set from a common base vacant, on the “same date” (Mass Valuation)

- Council land tax “Rates” are set by locale councillors answerable to their electorates.

- etc

By contrast, SLT agenda is designed to exploit the mass valuation methodology to selectively disadvantage and undermine freehold land existing use to

- impact existing use of freehold land

- promote Freehold land conversion into numerous strata lots

- generate and compound additional State Property taxes

This is achieved by SLT stealth planning agenda that is not generally appreciated, despite the overwhelming evidence.

It is done by

- imposing un-pegged SLT selectively on rental housing.

- applying a rapacious tax rate to impact freehold existing use

- adjusting taxable land values annually for un-pegged SLT

- allowing a tax-free threshold before SLT is imposed that advantages and promotes strata lots

- escalating the SLT tax rate when land value exceeds $2.22 million, increasing the impact on freehold land use for exclusively rental apartment blocks and small business that requires a freehold site.

NSW State Treasury SLT agenda has

- exacerbated the rental housing crises

- exacerbated demand for government subsidised rental housing and continues to do so.

Examples expose how a determined SLT agenda is applied to impact Freehold land existing use, showing the extent un-pegged SLT exceeds pegged council residential land tax “Rates”

In 2009, expressed as a percentage:

- Woollahra 2931%

- Waverley 1150%.

- Randwick 912%

- Parramatta 771%

- Manly 913%

- Ku-ring-gai 892%

- Hornsby 1223%

etc. etc

It is a major concern for this beautiful City of Sydney, that our State Governments has developed a craving to generate and compound additional State property taxes, using SLT to undermine freehold land existing use and promote its conversion into stacked strata housing. That has reached such a degree that the development business that builds strata stack housing, can be described as “the State Treasury construction arm”, generating and compounding additional state property taxes.

For an example, just look at what is occurring to freehold industrial land in the Redfern to Mascot potential ‘Horridor’.

Comparative Graphs

We will be posting up-dated comparative data graphs soon.

PS: Read the our 26th July 2011 letter to NSW Premier Barry O’Farrell.

(No reply from the Premier at 18th May 2012.)

This letter raises the question of SLT revenues connection with State Superannuation.

Mike Danzey

Certified Valuer.