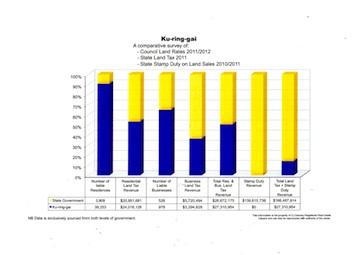

The following graph compares State Land Tax with Local Council tax (aka rates) for Ku-ring-gai Council. It shows:

- Council land rates 2011–2012

- State Land Tax 2011

- State Stamp Duty on Land Sales 2010–2011

Free information about NSW state land tax

The following graph compares State Land Tax with Local Council tax (aka rates) for Ku-ring-gai Council. It shows:

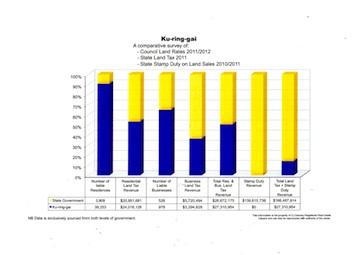

The following graph compares State Land Tax with Local Council tax (aka rates) for Randwick Council. It shows:

Note: Data is exclusively sourced from both levels of government.

This information is the property of CJ Danzey, Registered Real Estate Valuers and can only be reproduced with the authority of the owner.

Amalgamated councils remove the “local” from Local Government to centralise Planning control and make local councillors into political party apparatchiks directed by Macquarie Street.

Who collects the most revenue from land taxes in Council areas?

If you answered ‘Council’: WRONG

The correct answer is: The State Government by a country mile.

Name the major financial winners when freehold land sub-divides to strata lots?

If you answered ‘Builders’ — WRONG.

If you answered ‘property developers’ — WRONG.

The correct answer is: State Treasury and Banks, by a country mile.

Residents are often unaware that State property taxes are significantly generated and compounded when freehold land is subdivided into Strata Lots.

This is a major factor in State Treasury and the Development lobby wanting Planning administration centralised in Super Councils, since it will seriously diminish resident participation in Planning and reduce residents’ ability to protect existing streetscapes and local residential amenities.

And this is called “Town Planning”!

It’s clear that the fiscal connection between Treasury and the developer/finance lobby can, and has, corrupted Planning.

The data on this site exposes just THREE State Governments property taxes:

With The property taxes from Ratepayers and tenants all flowing to the State raised in Council areas the State Government wants abolish and amalgamated a Super Councils.

The State and Development Lobby float the fable that amalgamation is a magic bullet to save Local Council’s from fiscal ruin. However, it’s used to justify the delivery of the fiscal bounty that the proposed amalgamation State Treasury and the development lobby finger prints all over it’ A State addicted to property taxes. A Developments lobby possessed with endless greed.

If the State wanted to strengthen Council fiscal position, then the State needs to draw back on it’s ‘Take all, Catch all’ property tax policies in Council areas.

The following data expose the extent State Land Tax rate EXCEEDS Council’s Residential Rates in 2012:

This exposes State Government’s determination to selectively impose a State Land Tax in direct competition with Council’s Land Tax (aka “Rates”).

Amalgamation advocates are aware and silent how and why State Land Tax is designed to impact private Freehold land that is required for exclusively rental housing and high street small business and industry.

They are also aware the State Land Tax agenda encourages Freehold land to subdivide into numerous strata lots creating a fiscal bounty.

C.J.[ Mike] Danzey. Real Estate Valuer

Convenor landtaxforum.com.au

Chairperson — Bronte and Tamarama Advancement Society [1971]

Please note

We are in the process of up-dating this web site and expect significant data will be posted comparing state and locale Land Taxes early in 2014.

The data provided by this web site is provided in writing from Councils and State Government agencies. Great majority of Councils have been very supportive and our database goes back to 2001.

You may have read recently that the New South Wales State Government again raised the possibility of amalgamating councils into so-called ‘Super Councils’. For example amalgamating Marrickville, Leichhardt, City of Sydney, Woollahra, Waverley, Randwick, Botany. However local Liberal members realised they all would lose their State seats and have voted against creating these large local government areas. Nevertheless, the possibility of smaller amalgamations is still left on the State cabinet and Treasury table.

All the above was raised and considered after a State election where Barry O’Farrell promised to return decision making on development and building back to local councils.

The agenda to amalgate councils is high on the Property Council wish list. If delivered it would dramatically reduce residents’ representation by removing local grass-roots government. It appears intended to dilute residents’ right to influence and participate in local planning—that is, building and development—controls. The O’Farrell—Hazzard—Hartcher New Planning laws for New South Wales received criticism from the Independent Commission Against Corruption (ICAC), which warned that it opens opportunities for corruption.

The O’Farrell Government Cabinet is starting to resemble a board of directors from the ‘big end of town’, a position that will see the Liberals once again quickly erode their political credit won/handed to them by the previous corruption-riddled New South Wales State Government. However, Labor members that survived the March 2011 state election are being given significant reasons to re-build and defeat a government that seeks to finance a state by destroying housing standards—especially in established suburban areas—while employing taxes that impact existing use of freehold, residential, commercial, industrial lands to encourage strata sub-division. In our rural areas we have new-found instant wealth of a Natural Gas Agenda loaded against rural land users and in many cases impacting urban areas.

Where in the hell are we going in New South Wales? It appeared the O’Farrell Government is heading for the ‘big end of town’ and that may bring about some future directorships, it is certain to again a Liberal Sate Government that legislates residents’ rights and participation in Planning and Development be diluted.

The Liberals’ Planning Legislation is directed to encourage STRATA subdivision of existing suburban Freehold land use replacing freestanding housing with strata density housing, a develoment type that demands billions of dollars be used to amplfy and build infrastructure. Already all levels of schools are under pressure.

As this web-site data exposes, subdividing freehold land (hospitals, schools, waterfront, racetracks and so on) into numerous strata lots produces a massive cash flows to NSW Treasury, and banks make billions financing it. Just look at the Freehold land, much of it formerly public land, that has been stacked with strata housing to an extent there is mass over-supply that stock clearance relies on overseas and local investment buyers.

One suggestion put forward is to amalgamate the Municipalities of Waverley and Woollahra in Sydney NSW. It is said by those pushing amalgamation it will gain “Scale of Economies” assisting Local Council struggle to finance themselves.

Never does any other Politician or Property Council chorus -line advise how State Government has ruthlessly invaded Local Councils field of land taxing to finance State Government , which only survives on a sway of negative State taxes,and Federal Grants Some State taxes used to generate additional State Taxes. e.g. State Land Tax.

For example:

2011/12 Waverleys Council land tax “Rates”revenue from 29,618 properties = $35,685,430.

2011/12 Woollahra Council land tax “Rates” revenue from 25812 properties = $29,299,300.

Both Council ‘Rates” total = $65,984,730

Compared with State Land Tax (SLT) collected in Waverley and Woollahra

2012 Waverley SLT revenue 9142 properties, rental housing and small business = $63,831,323

2012 Woollahra SLT revenue 8302 properties rental housing and small business = $80,833,156

SLT revenue collected in both councils Total = $144,664,479.

2012 State Stamp Duty, land sales only raised in Waverley and Woollahra Total = $177,644,159

From just two property taxes in a 12-month period in Waverley and Woollahra the State Government raised $322,308,638.

The NSW since 2000 has received about 30% of GST raised nationwide—hundreds of billions of dollars.

In 2012, GST was estimated to raise $50,000,000,000 nationally. NSW receives about 30% — say $15 billion.

On top of that, add the revenue from numerous State assets that have been sold (too numerious to list). And yet the State Government is now concerned about Local Government finances when it is evident the billions of dollars taxpayers have paid and continue to pay in negative taxes to finance State Government.

Where has all the money gone?

Billions of State assets sold, taxes increased and introduced.

Amalgamation is not about Local Government finances it about State Government control over Planning, to promote Strata Housing.

A question is: Can we afford State Governments financed by negative taxes and Commonwealth subsidies. A State Government that promotes Strata housing to juggle budgets and imposes a State Land Tax to supplement Politicians pensions.

Ask: Why are all politicians silent about the impact of State Land Tax on rental housing and small business?

We could start investigating the cost of Parliamentary Pensions and perks ex-members continue to receive years after many have other professions,many as lobbyist etc.?

One place to start: Mr Pearce, the Minister for Finance (State Land Tax supplementing Politicians’ pensions)

Mike Danzey

Convenor

Landtaxforum