Thousands of tenants and families in NSW rely on rental housing which is imperilled by the NSW Government’s State Land Tax policies which adversely affect the economic viability of rental housing stock in the state. I wrote to NSW Parliament members to ask why.

Continue reading “Open letter to the Members of the NSW Parliament”

Author: Mike Danzey

State Land Tax vs privately-owned rental apartments

I believe this short video sums up exactly how NSW State Land Tax deals with Exclusively Rental Apartment Buildings If Privately Owned (ERABPO).

No prize for picking which which represents State Land Tax and which is its victim.

Everything changes, nothing alters

A Roman election manifesto

“The Budget should be balanced, the Treasury should be refilled, public debt should be reduced, the arrogance of officialdom should be tempered and controlled, and the assistance to foreign lands should be curtailed, lest Rome will become bankrupt. People must again learn to work instead of living on public assistance.”

Cicero, 55 BC

Ring any bells?

Land Tax Data – Ku-ring-gai

The following graph compares State Land Tax with Local Council tax (aka rates) for Ku-ring-gai Council. It shows:

- Council land rates 2011–2012

- State Land Tax 2011

- State Stamp Duty on Land Sales 2010–2011

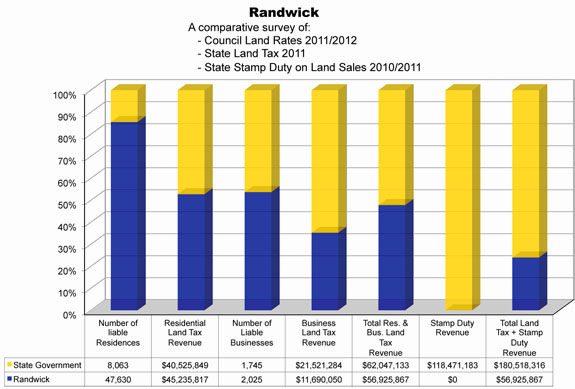

Land Tax Data – Randwick

The following graph compares State Land Tax with Local Council tax (aka rates) for Randwick Council. It shows:

- Council land rates 2011–2012

- State Land Tax 2011

- State Stamp Duty on Land Sales 2010–2011

Note: Data is exclusively sourced from both levels of government.

This information is the property of CJ Danzey, Registered Real Estate Valuers and can only be reproduced with the authority of the owner.