Our decision to withhold State Land Tax is not about profit. It’s about getting answers to important questions we’ve raised.

Download the PDF to read our case.

Free information about NSW state land tax

Dear Mr Perrottette,

Regarding your proposal that a wide-based State Land Tax (SLT) replace Stamp Duty (SD)

We seek information how the proposed wide-based SLT will be imposed in

NSW.

This is a monumental change to NSW land taxation that requires

explanation. The information requested

would be available accordingly, and we would appreciate receiving the

information ASAP.

This is fourth time the current State Liberal/National Government has

proposed a wide-based SLT. For example:

Additionally, the previous Carr/Egan State Labor government:

As stated, a wide-based SLT is a monumental taxation change requiring a

full explanation from any Government proposing it. Accordingly, initially

we seek the following information:

SD on land sales in Council areas 18-19 to November. Total State SD $7

Billion [ conservative]

SLT raised in Sydney council areas in 2020. SLT $6 billion + [

conservative]

Example. SD 18/19. and SLT 2020 raised small number of Sydney Council area

| Council Area | Stamp Duty | Land Tax | Number liable for Land Tax | |

|---|---|---|---|---|

| Ryde Council | $150,000,000 | $116,00,000 | 8954 | |

| Willoughby | $130.000.000 | $97,000,000 | 6225 | |

| Woollahra | $280.000,000 | $105,000,000 | 6656 | |

| Waverley | $125,000,000 | $100,000,000 | 9112. | |

| Inner West | $220,000,000 | $215,000,000 | 18,746 | |

| Ku-ring-gai | $235,000.000 | $ 66,500,000 | 5244 | |

| Northern Beaches | $410,000,000 | $178,000,000 | 5,045. | |

| North Sydney | $310,000,000 | $102,000,000 | 8399 |

SLT was reintroduced in 1955. All subsequent NSW governments prodigiously

expanded and increased SLT, especially in the years since 1980—90s,

undermining the fiscal viability of numerous exclusively rental housing

apartment blocks if privately owned or funded. SLT also adversely affected

small business need of a freehold site. A wide-based SLT has the potential

to destabilise Family Homes on freehold sites.

SLT is a planning weapon designed to fiscally erode existing use of

freehold land. We need to debate if SLT should be a Federal tax making it

equitable or if it should be abolished.

Yours faithfully,

C.J. (Mike) Danzey, Qualified and Certified Property Valuer

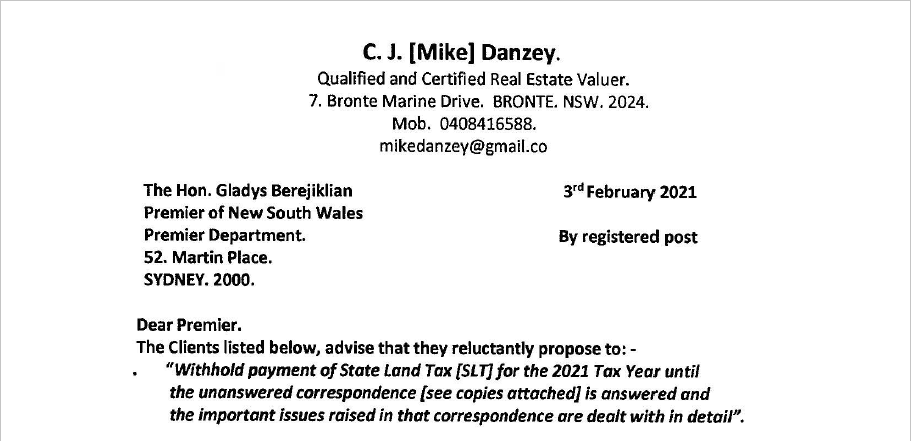

Dear Premier,

Subject: Elimination or substantial reduction of State Land Tax to encourage Social and Rental Housing:

Client 1290399. State Land Tax (SLT) 2020 has been increased to $45,200.

The current SLT on the above property known as 36 Alfred St, Bronte, 2024 has increased by an amount equal to $100p/w since the SLT assessment for 2018. This increase has virtually collapsed the fiscal viability of the existing use of the property as “Exclusively Rental Residential Apartment Building” (ERAB), if privately owned and funded. This is one of many examples of ERAB providing secure affordable housing being fiscally subverted by SLT.

Accordingly, I ask you and your advisers to reflect upon and respond to the comments and questions I have set out below:

Why is SLT used to collapse fiscal viability of property on land when the existing use is ERAB?

If use as “exclusively rental housing” is effectively removed while Politicians and their advisers and social commentators state that “a rental housing crisis exists” in many council areas in the State, how can you and your government remain silent on the impact of SLT in its present form, undermining ERAB fiscal viability of those relevant properties? It is at best contradictory and in reality, makes no sense.

Previous submissions made on this topic have in the past received the same drafted formula reply from the Treasury which avoids the essential issue — a tactic to control and evade the need for prompt action on this important issue.

“State Land Tax is needed to fund schools, roads and hospitals”

While the need for the above is correct and fully recognised, a broad brush approach to the imposition of SLT does not solve the real problem. Hundreds of millions of dollars of funding is made available to subsidise rental housing and, in includes the imposition of taxation on some properties which render them unaffordable for renters. This position is further impacted by the addition of the Affordable Housing Tax on new developments and Strata Approvals. Affordable Housing is of course supported when the need exists. However, the following question is never directly answered:

“How is a rental housing crisis ameliorated by a SLT agenda that, impacts fiscal viability of ERAB property”?

Private/social rental housing became a political football in NSW as early as the 1928 elections and remains so to the present time. Why does this issue continue to exist in its present form?

ERAB requires a Freehold site — SLT design and application target and impacts such sites. VG imposed land tax valuations — ignore existing use as ERAB of any freehold land. What is the justification for this?

VG land tax valuations of ERAB sites applies as comparable, land sales not liable to SLT. Why does this anomaly persist?

Unlike commercial tenants, residential tenants cannot claim rental payments as Federal tax deduction (apart from any small areas if, used as a home office).

Politicians and others, in many council areas, constantly advise of a rental housing crisis in many parts of New South Wales.

SLT impacts ERAB significantly in those council areas which are identified by many politicians and others advise, have an affordable rental crisis, and indeed a general renting crisis.

The way the SLT is currently designed and imposed destabilises ERAB fiscal viability of property and, in turn, exacerbates the rental and affordable renting housing crisis. Why is it permitted to continue in such form when it has such an adverse impact on this important issue?

ERAB use property is restricted in its intended purpose of providing affordable stable rental housing as it is currently targeted by SLT. That position should be remedied as soon as practicable.

The current design and imposition of SLT is machiavellian at best and discourages any constructive focus on it and awareness of it by Tenants, commentators, analysts and the media. Treasury responses to date simply obfuscate the real issue and adverse impact of the current SLT structure.

In NSW, the following recent attempts have been made to expand SLT:

Carr Governments — Premium Property SLT targeted homes in Sydney inner council areas. Catchall SLT on rental housing and small business. Both taxes collapsed as Bob Carr resigned.

Mike Baird as Treasurer proposed a catchall SLT at 0.7%. A major transfer of SLT to residential land, especially on freehold homes. Mike Baird was sent a confidential report showing impact on freehold homes and his likely defeat in Manly. He subsequently asked the report be sent to Treasury. Catchall SLT not proceeded.

Subsequent proposals called SLT a Levy.

Unfunded State Superannuation of $49 billion which is proposed to be funded by 2030, may be a strong factor driving Treasury’s persistent efforts to impose/expand SLT to a ‘catch-all’ Land Tax in NSW. This is proposed as Treasury must be aware that a ‘catch-all’ state Land Tax will be inequitable and an attack on the family home — especially homes occupying freehold land. SLT now attacks tenants homes provided by existing ERAB.

Rental Housing became a political issue during the 1928 NSW Election and remains a ‘political football’ which has constant support of the left-wing faction of politics. NSW continued to impose a momentous subsidised rental housing lockdown from 1946 to approximately 1990 (which was introduced by the Federal Government as a war-time precaution). This was a mass enforced rental and occupation lockdown which was totally funded by existing private rental housing providers. Numerous ERABs were fiscally impacted by this lockdown, where it became a post-war political tool.

Currently, a several decades later, existing ERABs are being impacted by State Land Tax. Is there a pattern emerging here? The consequences of this rental and occupation lockdown left many suburban areas of Sydney (such as Paddington, Newtown, Balmain etc.) labelled as slum areas. As reflected by the idiom first said by Ben Chifley: ‘To get and remain elected, you create policies that touch the hip-pocket nerve’.

I ask you respond in detail to the questions I have set out in this letter.

“How is a rental housing crisis ameliorated by a SLT agenda that, impacts fiscal viability of ERAB property”?

I request that your government change the existing SLT policy as it clearly is subverting ERAB. This is especially relevant in the Council areas where your Government and others (e.g. social housing lobbies) are constantly emphasising the existence of a rental housing crisis whilst remaining silent about SLT.

This consequently undermines the fiscal viability of existing ERAB. This is occurring while taxpayers are called upon to fund more taxpayer subsidised housing. In my opinion, this is significantly influenced by the concern that the gentrification of many council areas is altering the political allegiances of the residents.

Yours Faithfully,

C.J. (Mike) Danzey.

Qualified and Certified Real Estate Valuer

Yarran Investments P/L

The affordable housing and rental issues are contaminated by political hypocrisy and industry propaganda agendas, chanting in unison concern about “rental housing crises”. Media reports these outpourings, producing simplistic fake news. Politicians expressing ‘concern’ about affordable rental housing reaches back to the 1928 NSW Election. Since then we have been overdosed with political hypocrisy and generalization about rental housing affordability. It reflects the idiom “To get elected and remain elected, have policies that touch the hip-pocket nerve”.

NSW annual State Land Tax (SLT) for 2017 attests the political hypocrisy and agenda-driven concerns of industry participants’ about NSW affordable rental housing, aware, SLT is designed target private owned exclusively rental apartment blocks need of a Freehold site.

| Number of properties | SLT imposed | |

|---|---|---|

| Sydney Statistical Area | 177,897 | $1,100,000,000 |

| Regional NSW | 41,976 | $275,574,000 |

| Totals | 219,873 | $1,375,574,000 |

NSW SLT knows no bounds taxing and targeting regional rental housing. For example:

Etcetera.

Hypocrisy! Politicians’ rare unison of silence about a SLT designed to target and impact viability of privately-owned rental housing, especially in council areas said to have a rental housing crises. This, while The Property Council lobbies for a catchall SLT, exposing every suburban family home.

The Land Tax Forum provides official data about NSW State Land Tax (SLT) seeking to explain how and why this little-understood insidious tax, is designed to impact the existing use of freehold land if privately owned. Proposals of a “catchall SLT” are disguised as Levy — taxing land values imposed by the current land valuation methods. A catchall SLT has real potential to undermine free-standing family homes on freehold land. Also SLT can be imposed in direct competition with council rates — local government’s own land tax. This has been proposed because certain established councils are to be abolished as unviable. To say the least: contradictory.

A catchall SLT reduces existing liability on business land, spreading liability across all land use. Proponents of catchall SLT never raise the fact that SLT is not tax deductible against Federal tax liability on the family home, just like all other taxes and charges aren’t. However, for land used for business, all costs are deductible against Federal tax liability, while catchall SLT reduces liability.

Of course, you know why the Property Council and NSW Treasury supports a catchall SLT. They know a catchall will impact existing use of suburban lands.

In NSW, a catchall SLT will further fund State Superannuation and cannot be evaded — it becomes an estate in all private liable land, which if not paid, the State can and will lodge caveats on title. Impose usury interest rates on arrears, before taking possession and selling the land, warning such action can endanger mortgage agreements etc.

Read the Office of State Revenue’s current letter of demand soon on landtaxforum.com.au