Attention Tim McIntyre, Editor

Hi Tim,

The proposed State Land Tax (SLT) formula to be introduced in 2021 State Budget I believe will impact family homes on freehold land especially, in established residential areas. This is the fourth attempt by the current NSW Government / Treasury, to impose a catchall SLT. It only targets land that is now SLT-exempt.

The Carr Governments

Imposed SLT selectively on family homes (premium property land tax} it collapsed, however, soon imposed SLT on every commercial and private funded rental housing in NSW. (Tax-free threshold was removed)

That effort lasted just 12 months and Carr and Egan resigned soon after its implementation.

Attempts to impose a catchall SLT

| Barry O’Farrell | Proposed a catchall levy on all land. Did not proceed |

|---|---|

| Mike Baird | Proposed 0.7% SLT on all land. Did not proceed. (Mike Baird was provided data that would see him defeated in Manly) |

| Gladys Berejiklian | Proposed catchall levy on land to fund Emergency Services. Postponed. |

| Dominic Perrottet | Proposes, initially, a formula to avoid Stamp Duty if(!) the purchaser agrees that SLT-exempt land becomes perennially liable to SLT. |

None of the politicians above advised homeowners that, unlike business land, the Family Homes cannot deduct costs against Federal Tax liability. For example, SLT, Council, Water, Energy, Repairs/Maintenance, interest, insurance, GST etc

None respond to correspondence regarding SLT’s impact on rental housing and small business.

Dominic Perrottet’s NSW Treasury formula only applies to land now not liable to SLT such as the family home, farms, nursing homes, boarding houses and so on. They are all proposed to become perennially liable for SLT when the first purchaser elects to avoid stamp duty.

Many homeowners may not be aware SLT is an annual tax, annually adjusted to annual Site Value adjustments and that it taxes site value (not UCV). SLT prime impact is upon freehold land enforced by severe recovery options.

Family Homes on freehold land in established residential areas are the formula targets, such as those in Council areas The Courier Newspapers publish in.

The formula seeks to fly under homeowners’ radar while handing a tax windfall to property developers, dealers, renovators, shor-term owners, spec builders. All of those groups avoid stamp duty but, by agreeing, exempt land use becomes, perennially liable for SLT.

First home buyers can be assisted by State by waiving stamp duty instead of seeking to SLT existing family homes etc. Already, NSW taxation, charges, and so on are at usary levels without going after family homes and farmers.

SLT has decimated privatel- funded exclusively rental housing, especially in established residential areas, yet Governments invest billions in subsidized rental housing because of rental crises.

State revenue on land sales in 2020

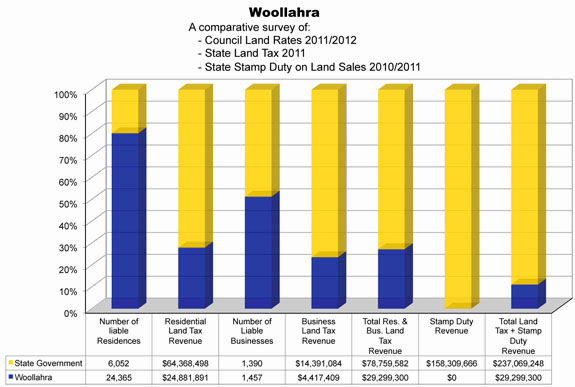

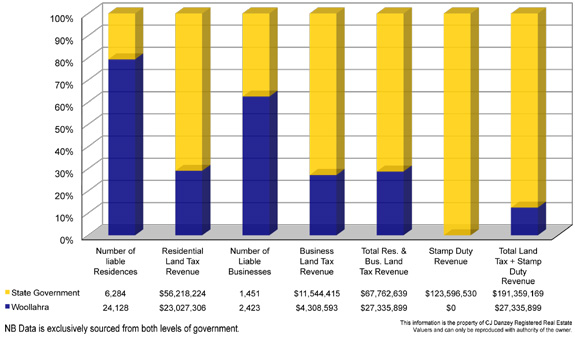

The table below shows the massive sums collected in SLT and SD on land sales. It includes data from one year only from the Randwick, Waverley, Woollahra and City of Sydney Council areas.

| SLT on private rental housing | SLT on business lands | SD on land sales only | Total | |

|---|---|---|---|---|

| Randwick | $86,000,000 | $21,000,000 | $225,000,000 | $332,000,000 |

| Waverley | $73,000,000 | $23,000,000 | $125,000,000 | $221,000,000 |

| Woollahra | $84,000,000 | $20,000,000 | $285,000,000 | $389,000,000 |

| Sydney | $107,000,000 | $640,000,000 | $788,000,000 | $1,535,000,000 |

All rounded total: $2,477,000,000.

Note that this figure is conservative, and the does data does not include revenues received after 4 November 2020. Data was provided by NSW Treasury.

Regards,

Mike Danzey