Amalgamated councils remove the “local” from Local Government to centralise Planning control and make local councillors into political party apparatchiks directed by Macquarie Street.

Question 1

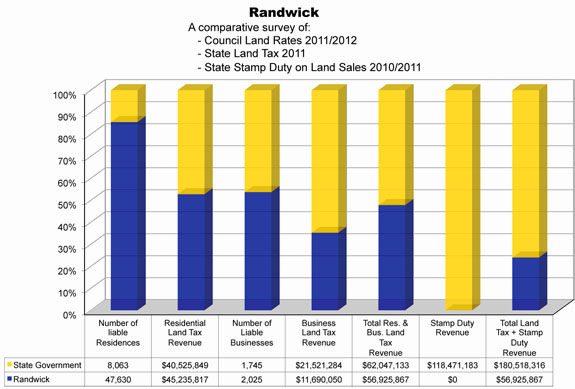

Who collects the most revenue from land taxes in Council areas?

If you answered ‘Council’: WRONG

The correct answer is: The State Government by a country mile.

Question 2

Name the major financial winners when freehold land sub-divides to strata lots?

If you answered ‘Builders’ — WRONG.

If you answered ‘property developers’ — WRONG.

The correct answer is: State Treasury and Banks, by a country mile.

Residents are often unaware that State property taxes are significantly generated and compounded when freehold land is subdivided into Strata Lots.

This is a major factor in State Treasury and the Development lobby wanting Planning administration centralised in Super Councils, since it will seriously diminish resident participation in Planning and reduce residents’ ability to protect existing streetscapes and local residential amenities.

And this is called “Town Planning”!

It’s clear that the fiscal connection between Treasury and the developer/finance lobby can, and has, corrupted Planning.

The data on this site exposes just THREE State Governments property taxes:

- State Land Tax

- Stamp Duty

- The proposed $300 Fire Levy on all taxable property

With The property taxes from Ratepayers and tenants all flowing to the State raised in Council areas the State Government wants abolish and amalgamated a Super Councils.

The State and Development Lobby float the fable that amalgamation is a magic bullet to save Local Council’s from fiscal ruin. However, it’s used to justify the delivery of the fiscal bounty that the proposed amalgamation State Treasury and the development lobby finger prints all over it’ A State addicted to property taxes. A Developments lobby possessed with endless greed.

If the State wanted to strengthen Council fiscal position, then the State needs to draw back on it’s ‘Take all, Catch all’ property tax policies in Council areas.

The following data expose the extent State Land Tax rate EXCEEDS Council’s Residential Rates in 2012:

- Marrickville 730%Leichhardt 700%Randwick 930%

- City of Sydney 960%Waverley 1150%Woollahra 3470%

This exposes State Government’s determination to selectively impose a State Land Tax in direct competition with Council’s Land Tax (aka “Rates”).

Amalgamation advocates are aware and silent how and why State Land Tax is designed to impact private Freehold land that is required for exclusively rental housing and high street small business and industry.

They are also aware the State Land Tax agenda encourages Freehold land to subdivide into numerous strata lots creating a fiscal bounty.

C.J.[ Mike] Danzey. Real Estate Valuer

Convenor landtaxforum.com.au

Chairperson — Bronte and Tamarama Advancement Society [1971]