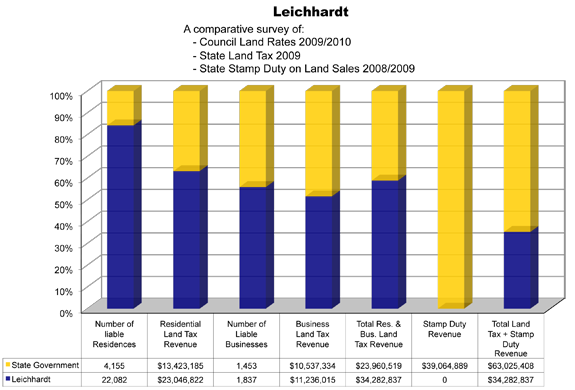

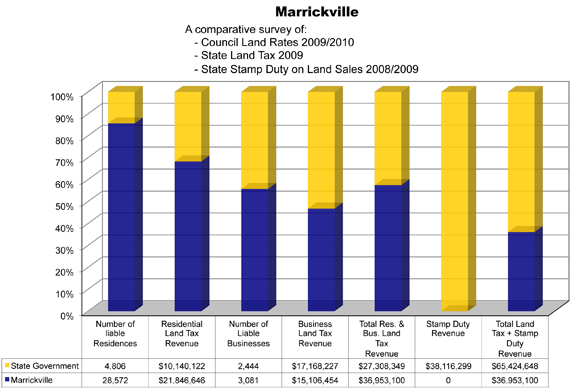

A comparative survey of:

- Council Land Rates 2008/2009

- State Land Tax 2008

- State Stemp Duty on Land Sales 2007/2008

Free information about NSW state land tax

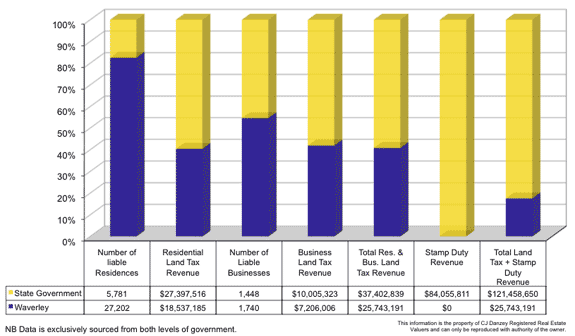

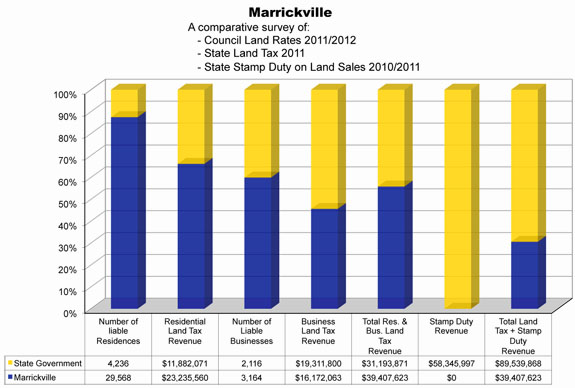

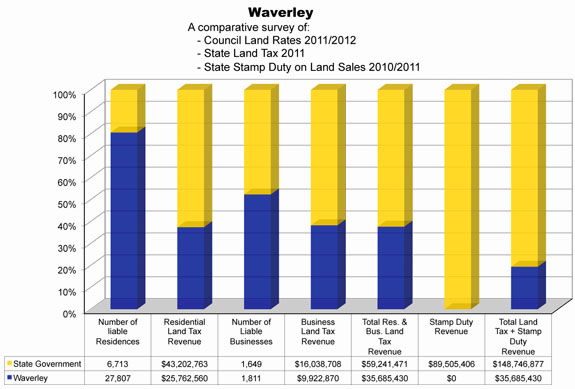

A comparative survey of:

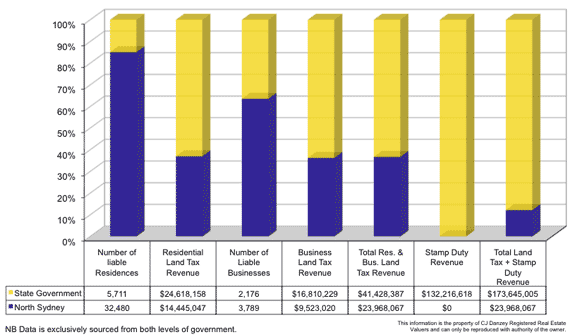

A comparative survey of:

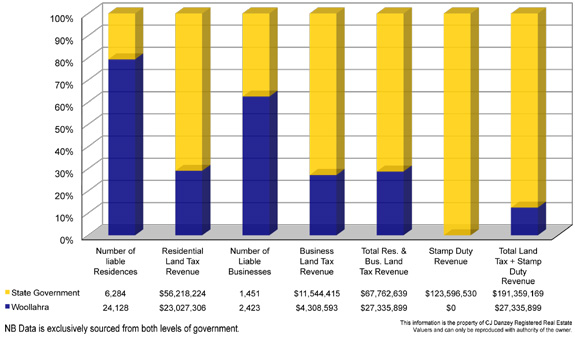

Property owners and their tenants in 2010 paid a total State land tax bill of $67,762,639.

1451 Small business paid $11,544,415

6284 Rental housing paid $56,218,224

By comparison.

Property owners and their tenants if rented in 2009/10 paid a total council land tax bill of $27,335,593.

2423 small business paid $ 4,308,593

24128 residential paid $23,027,306

State land tax on Woollahra rental housing, EXCEEDS, Woollahra council total land tax revenue by $28,882,631

This is common in most LGAs in the Sydney region and coastal council’s.

This Woollahra situation is common in most LGAs as unpegged State land tax undermines rental housing, while restricting council revenues by rate pegging, thus forcing councils to rely on parking meters and fines. This financial strangulation of councils is connected

The treasury agenda that has caused the removal of 100s of rental apartment blocks was also the policy of the previous Labor State government, who constantly feigned concern about a rental crises while undermining rental housing.

It is not generally appreciated how this was/and is still being done. Please read through the information on the landtaxforum.com.au which will give a precise how and why.

We think State land tax is used as a stealth-planning instrument to undermine existing use of freehold land and promote its development as strata lots. Just look at how accommodation hotels have been driven to strata, and the 100’s of previously exclusively rental apartment blocks.

Council Land tax ‘Rate’s’ are pegged and politically enables unpegged State land tax to target freehold land used as rental housing and small business. Nevertheless, Local government leaders are calling for the end of ‘rate pegging’.

It is my experience they have not appreciated the consequences of this on the existing use of freehold land. The paradigm is how and why unpegged state land tax has undermined liable freehold lands existing use.

The comparisons have been carried out since 2001 and display the significant growth in state land tax in all LGAs especially upon rental housing . That exposes the wreckage state land tax agenda has delivered to rental housing.

Premier Bob Carr refused to respond to our letter to him as member for Maroubra and (former) Premier.

Landtaxforum will be displaying the comparative graph of various councils exposing the ruthless treatment of rental housing and small business in 2010.

Mike Danzey, valuer.

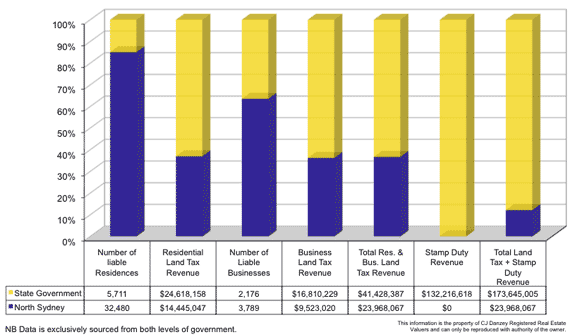

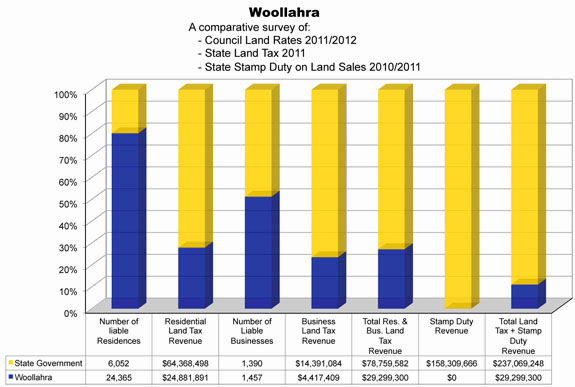

A comparative survey of: